D2C, D to C or DTC, stands for direct-to-consumer, a business model that cuts the middleman (e.g. wholesalers and retailers) and allows brands to control the end-to-end process, i.e. manufacture and market their product, as well as take care of order fulfillment.

Brands and consumers can both win with D2C, with manufacturers enjoying gross margins on sales (saving approximately 10-15% from wholesale distribution and 15-40% from retailers)1 and owning first-party data to better understand end-consumers, and consumers, on the other hand, benefiting from lower cost offerings and improved experiences.

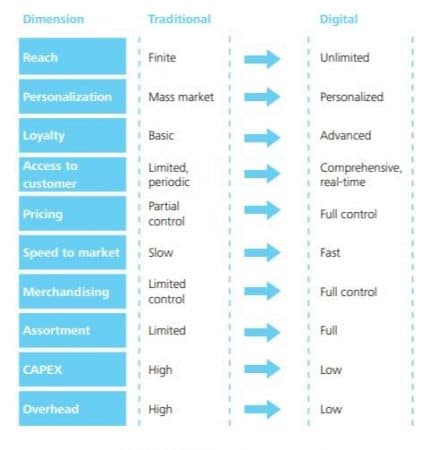

Deloitte compiled D2C’s benefits for brands in this chart:2

(Image Source: Deloitte)

A closer look at most of these benefits reveals D2C’s appeal for manufacturers:

Expanded reach

Unhampered by physical location, geography, time zone and even language, D2C brands can market via social media, sell through e-commerce and deliver products using third-party fulfillment service providers. This is in sharp contrast with the traditional model, where manufacturers are constrained by a retailers’ reach.

Personalization

With access to an incredible wealth of data generated by digital tools and platforms, D2C brands can better understand their customers’ journeys towards a purchase. Armed with insights from first-party data, they can offer personalized experiences to specific segments and individuals, therefore improving sales as well as customer retention and satisfaction.

Customer loyalty

By owning the customer relationship, D2C brands get to know their customers deeply and thus, can deliver targeted value propositions. Through personalization and continuous engagement, they are better positioned to establish and grow loyalty from their customers.

Full assortment

With D2C, brands are free to lay out a comprehensive assortment of their products—how, where and when they want. This is unlike the traditional model, where they are restricted by a retailers’ shelves and goals.

Pricing control

Brands that have gone direct can A/B test their price to find out what works with consumers. They can also freely increase or decrease pricing according to the economics of their business unlike when they only have partial control of pricing as they have to defer to the price set by the wholesalers or distribution outlets.

Full control of merchandising

When brands own all their channels in D2C, they can offer the right products to the right consumers according to data, unlike when merchandising was the retailers’ call.

Time-to-market

Without middlemen who have to own their timing and requirements (i.e. must show proof of success for products to be distributed in certain locations), D2C brands can sell and deliver products to consumers whenever they want.

D2C threatens retail by cutting into its market share

According to Diffusion's 2018 D2C Purchase Intent Index, more and more Americans are poised to buy from D2C brands within the next five years:3

- A third will make 40% of their purchases from D2C brands

- 81% will make at least one purchase from D2C brands

However, despite these numbers, eMarketer found that only department stores and other traditional mall-based retailers will be affected, not retail giants such as Amazon, Walmart, and Target.4

Has D2C really upended retail?

By being agile and leaving the old-school supply chain process behind, eliminating dependences on third-party distribution systems, and controlling their branding, many D2C companies have found success. Furthermore, by highlighting their truths and values, D2C companies have also increased their appeal to the millennial segment.

In addition, D2C brands have made efforts to understand end-consumers, offered flexible pricing schemes, provided delivery/shipping options, and built trust through rich content and unparalleled customer service.

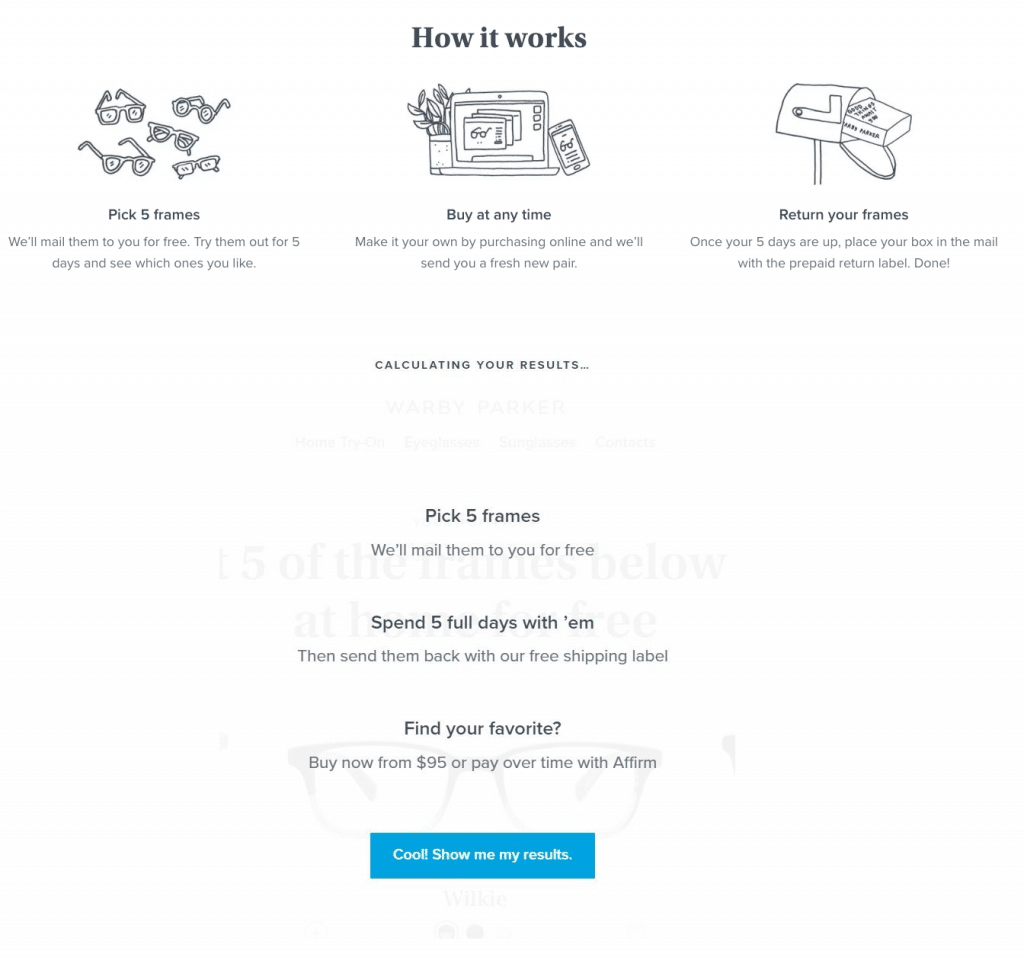

Take D2C’s poster child, Warby Parker’s success as an example. How did the hipster brand turn the eyeglasses industry upside-down without a physical store? Since they know their target segment, they used narrative storytelling and a creative Instagram ad strategy to hook and engage,5 eventually causing hundreds of other fashion and lifestyle brands to follow their example.

Here’s an example of how Warby Parker eliminated the top concern of consumers when it comes to buying wearable products online (the fact that consumers can’t physically try their products on):

(Image source: Warby Parker)

The content may be short, but it used simple instructions, clean designs, spoke their target’s language, and, most importantly, gave them the freedom to choose. Warby Parker also provided shoppers with a fun, frictionless, and personalized experience – things that retailers might struggle to provide.

D2C intensifies the competition

Due to the success of D2C startups, more and more players have come into the scene. It includes big names such as Nike and Apple, making an already tight space even tighter and creating a suffocating environment for retailers, competition-wise.

Nike has been so successful with D2C that it stopped selling to Amazon in 2019. Although the decision might have included issues with counterfeits, Nike shared with Retail Drive that it’s more about improving customer experience, “As part of Nike's focus on elevating consumer experiences through more direct, personal relationships, we have made the decision to complete our current pilot with Amazon Retail."6

What was Nike’s D2C strategy? They called it “Consumer Direct Offense,” which aims to “serve consumers personally, at scale” and entails enhancing their digital efforts through mobile apps.7

Through the Nike Customer Experience (NCX) program,8 the brand aims to create more personal connections with customers through the “30-day free returns, dirt and all” free trials, access to the Nike Plus rewards program, and Nike experts and personalized exercise routines and more.9

(Image source: Heidi O'Neill and Adam Sussman's Transcript)

The D2C industry was forecasted to account for $17.75 billion of total US e-commerce sales in 2020, further proving that this business model pays.

Here’s a list of top D2C brands:10

- Warby Parker, valued at $1.75 billion

- Dollar Shave Club, acquired by Unilever for $1 billion

- Casper and Harry's, each valued at about $750 million apiece

- Glossier, valued at $390 million

- Bonobos acquired for $310 million

- BarkBox, worth between $150 and $200 million

D2C’s success also has implications on marketing, as companies that used to invest in advertising and brand-building in physical stores are now looking at digital because there is where the consumers are shifting to.

As Racantour puts it, “Once a consumer has downloaded the company’s app or logged into its website, the entire experience takes place in a digital, walled garden and can be highly personalized.”

But it’s not only in the online space that D2C brands are besting retail. They’re also encroaching on retail’s physical spaces as many have opened brick-and-mortar stores to fulfill their omnichannel goals.

But then there’s Amazon and Walmart

D2C is here to stay. This means it’s up to retailers to rise to the challenge and evolve. They must note that retail remains a vital channel in an omnichannel environment, and look to Walmart and Amazon, which are blurring the lines of retail and D2C, for inspiration. For these two giants, the motto seems to be, “If you can’t beat them…”

Sources:

- Direct to Consumer Strategy, an Expert's Guide

- Deloitte, Consumer Business Going Digital / Going Direct

- Diffusion's 2018 Direct-to-Consumer Purchase Intent Index

- The Future of Retail 2020

- Warby Parker Marketing Story

- Nike to stop selling on Amazon

- Nike consumer direct offense

- Nike Direct - Heidi & Adam's Transcript

- How Nike combines customer centricity with brand reputation to stay on top

- Direct-to-Consumer Start-ups You Need to Know